Credit Cards Built For Nonprofits

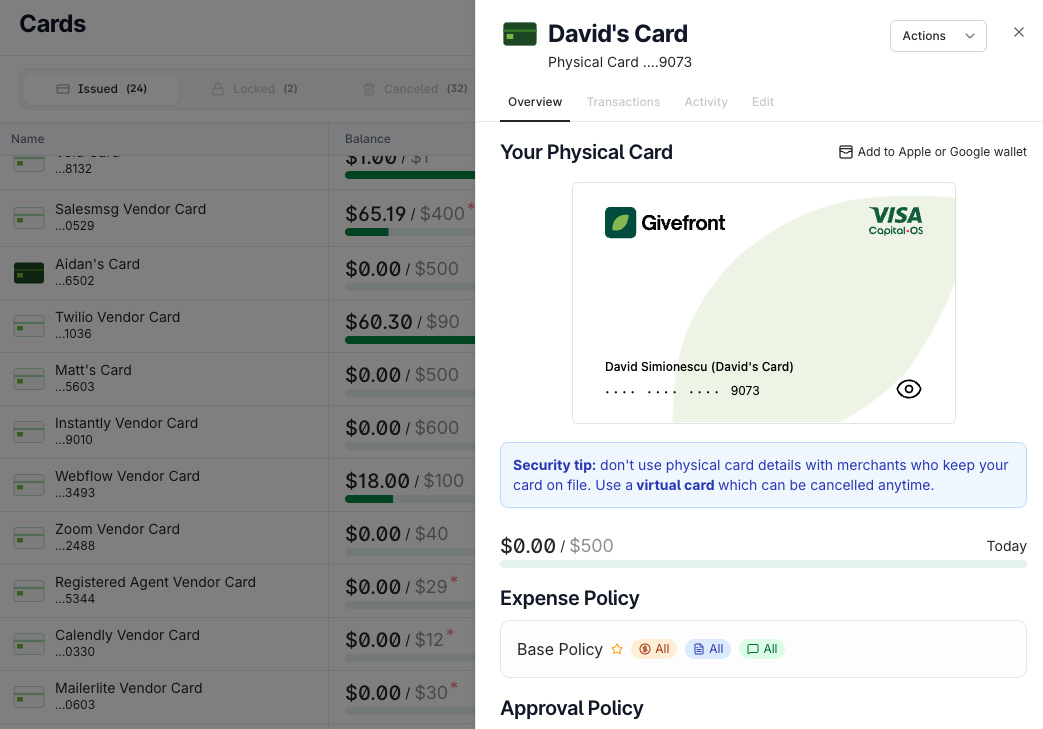

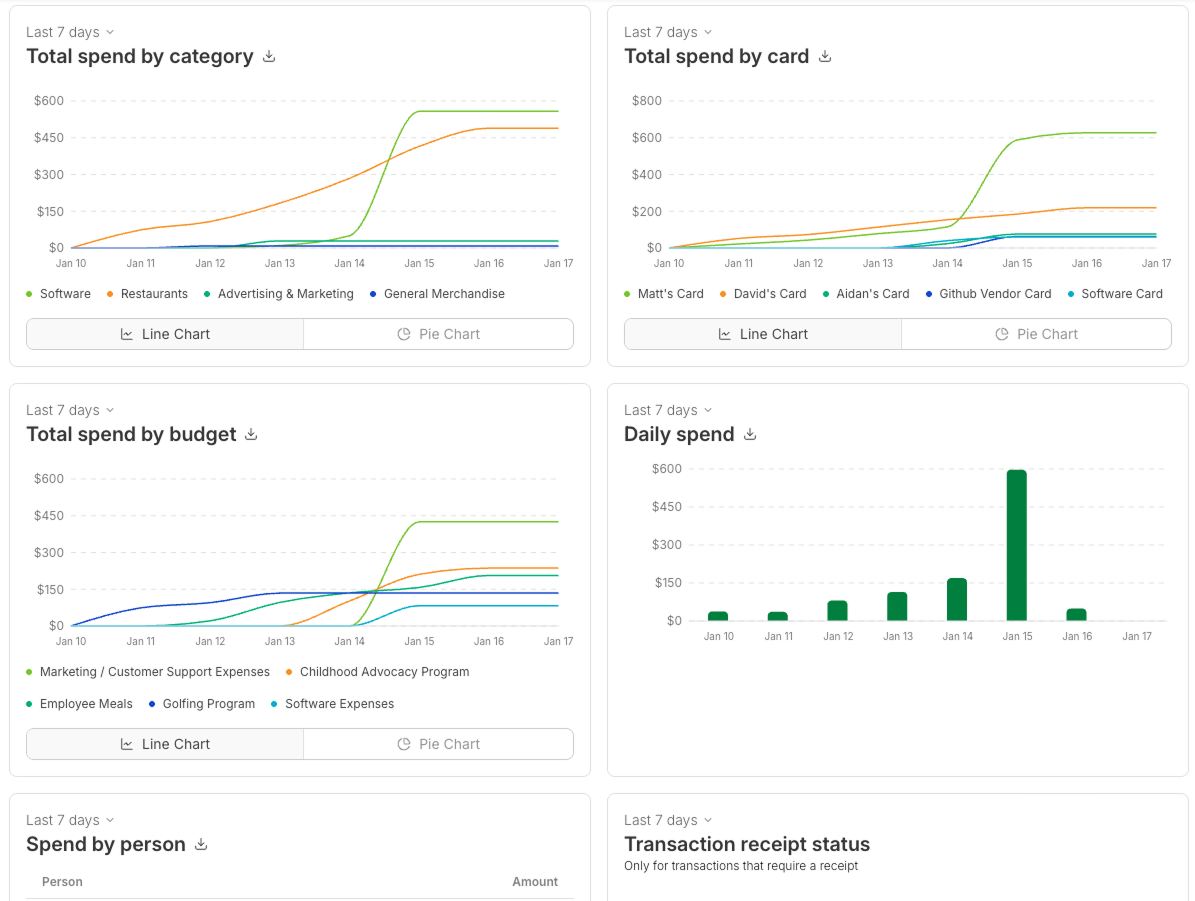

Smart virtual and physical cards. Built-in spend controls keep you in control, and you can track every dollar spent.

Smart virtual and physical cards. Built-in spend controls keep you in control, and you can track every dollar spent.

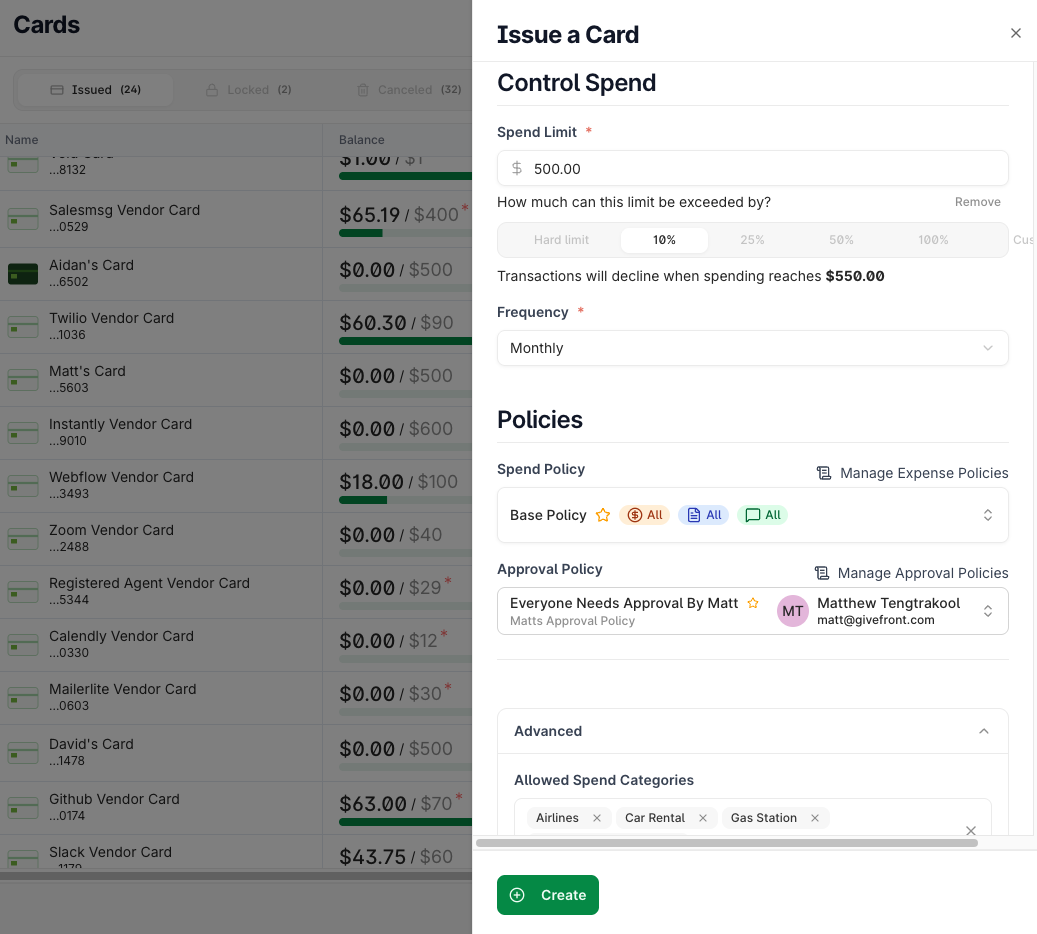

Assign dollar limits to each card to stay on budget and prevent overages.

Give employees and volunteers the access they need—nothing more.

Cards are issued to your nonprofit—not to individuals. No credit checks, no personal risk.

No annual fees, no surprise charges. Simple, transparent, nonprofit-friendly.

.png)

Every Givefront card comes with customizable controls—so you can control spending by team member, vendor, or category.

.png)

AI-powered fraud detection, and automated reporting, to ensure every transaction is compliant.

Givefront connects directly to your accounting system—tagging transactions by fund, program, or grant, and syncing them with your chart of accounts.

Any registered nonprofit organization can apply. We support organizations of all sizes, from grassroots groups to national nonprofits.

No. Givefront cards are issued to your organization. Your credit limit is based on your organization’s financial profile—such as bank balance, income history, and fundraising volume. We assess this automatically to give you a credit line that fits your capacity.

There are no annual fees, setup fees, or card issuing fees. ²

Absolutely. You can set spending limits, restrict categories, and assign cards to specific funds, programs, or team members.

Anywhere Visa is accepted—online or in-store, locally or internationally.